Did you know there is a free tool you can use to see why your health insurer denied your insurance claim? ProPublica’s Claim File Helper lets you customize a letter requesting the notes and documents your insurer used when deciding to deny you coverage. Get your claim file before submitting an appeal.

Medical Debt Resources

Do you have unpaid medical bills? Here are some tips from unduemedicaldebt.org.

- Don’t pay with your credit card unless you have the money available.

- Ask for financial assistance, even if your hospital stay was a year ago

- When you apply for financial assistance, let them know about other large bills you have. Even if your income is good, you may not be able to pay.

- If you don’t get financial assistance, ask for a payment plan.

- Do you struggle with negotiation? Get a friend to do the call with you.

- No one returning your call? Contact the hospital Patient Representative.

- Don’t stop taking medications or going to the doctor.

The Maine Easy Enrollment Tax Referral Program

The Easy Enrollment Tax Referral Program is the “check the box’ option on your Maine state tax return form 1040ME to opt-in to receive more information about the health insurance options available to you. When you opt-in, you authorize the Maine Revenue Services to share your name and contact information with CoverME.gov. We will use this information to send you a communication about how to get enrolled.

How it works

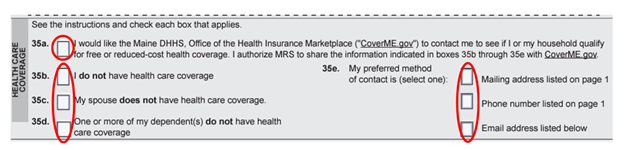

- Check all boxes on form 1040ME that apply to your household. Let us know that you’d like more information about health insurance coverage, who the coverage would be for, and how you prefer to be contacted. By checking the boxes, you give the Maine Revenue Services permission to share your contact information with CoverME.gov. Here’s an example:

- File your taxes. After you file your taxes, the Maine Revenue Services will share your contact information with CoverME.gov so we can contact you with more information.

- Watch for the CoverME.gov communication. Once we receive your information, CoverME.gov will contact you by mail, phone or email to explain how to enroll in health coverage. You’ll have 35 days from the date we contact you to sign up.

- Contact me and I will help you get enrolled. You can link me to your coverme.gov account by clicking on get help or get assistance. Type in Stacy Dostie, and select me. I will receive notification that you need assistance and I will contact you to setup a time to meet.

Need Prescription Help?

Are you looking for help with your prescription costs? There are programs that can help.

Needy Meds: Here you can find prescription assistance programs from the pharmaceutical companies. Most brand name drugs have some kind of copay coupon or assistance program. Many are not determined by income eligibility, only by need.

MaineHealth MedAccess: MedAccess works with individuals and providers to identify ways patients can save money on prescription meds. This is a free program administered by MaineHealth.

Maine Rx Plus: If you are over the income level for MaineCare, you may get a discount on some prescription drugs. If you are eligible, you may save up to 60% on generic drugs and up to 15% on name brands. You will need to apply to MaineCare to see if you are eligible. There are no asset limits for Maine Rx Plus.

Medicare Savings Program: This program helps pay monthly Medicare premiums and out-of-pocket costs. People who qualify for the Extra Help Program through SSI may get help with prescription drugs.

Medicare negotiated drugs for the 2026 plan year

A new law provides Medicare the ability to directly negotiate the prices of certain high expenditure, single source drugs without generic or biosimilar competition. The Centers for Medicare & Medicaid Services (CMS) selected ten drugs covered under Medicare Part D for the first cycle of negotiations for initial price applicability year 2026 and engaged in voluntary negotiations with the drug companies for the selected drugs.

Here is the list of negotiated prices, which the statute refers to as Maximum Fair Prices (MFPs), for 10 drugs covered under Medicare Part D that will go into effect beginning January 1, 2026, based on negotiations and agreements reached between CMS and participating drug companies

Generate a health insurance appeal with AI

Do you need help writing your health insurance appeal? Try out this tool which helps you write the appeal to help overturn your insurance denial. https://fighthealthinsurance.com/

Insurance Superintendent Warns Mainers About “Self-Funded” Health Plans Offered to Individuals

Today, I read a post from The Maine Bureau of Insurance. It is below. If you are looking for individual or group health insurance in Maine, please only work with a licensed broker and a licensed health insurance company.

___________________________

Bob Carey, Superintendent of the Maine Bureau of Insurance, which cautioned Maine residents to be aware of salespeople offering “self-funded” health plans to individual consumers. The latest pitch involves so-called self-funded health coverage that makes people “limited partners” or “part owners” of an employer group that is offering these plans.

“These plans do not provide comprehensive medical coverage and can leave consumers with large, unpaid medical bills. Mainers should proceed with caution before signing up and paying a monthly premium. The Bureau has already intervened in cases where Maine people have contacted us after they’ve paid a monthly premium and then had their medical claims denied,” Carey commented.

Information about the partnership or owner arrangement is often embedded within the agreement consumers electronically sign prior to enrolling in the coverage. Some of the groups marketing self-funded coverage to Maine people include:

•Affiliated Workers Alliance

•Consumer Data Partners, LP

•Employers Business Alliance, LLC

•Innovative Partners, LP

•Socios Buenos, LP

•Strategic Limited Partners

•The Vitamin Patch, LLC

These groups do not offer major medical plans.

Major medical plans cover a full range of medical services, including preventive care, office visits, inpatient and outpatient services, prescription drugs, and emergency care. These health plans are licensed and overseen by the Bureau of Insurance.

Unlike major medical plans, some of these self-funded plans only cover preventive services such as a yearly check-up or annual health screening. Other plans place limits on the number of services, like doctor visits, that will be covered. There are even some self-funded plans that restrict this already limited coverage by not covering preventive services if they are provided in a hospital facility.

Carey noted, “While the monthly premium for these self-funded health plans may be lower than a major medical plan, consumers may face very high out-of-pocket costs from uncovered medical expenses. A health plan that covers only preventive services will not cover visits to your doctor beyond an annual physical, won’t cover drugs to treat chronic health conditions, and won’t cover a hospital stay. These medical services can cost tens of thousands of dollars.”

To determine if you have purchased coverage through one of these groups, look at the documents that were emailed after you enrolled in the plan and look at the insurance card they may have sent you. The group may not even send a physical card, so consumers should check their email for an ID card.

If you are worried that you do not have the type of insurance you thought you purchased, call the Maine Bureau of Insurance. Bureau of Insurance staff are available during normal business hours to help you understand the coverage you purchased. The Bureau can be reached at 207-624-8475; TTY: 711 or 800-300-5000 (toll free).

As a reminder, the only way to purchase major medical plans in Maine is through CoverME.gov, directly from an insurance company, or from a licensed agent. The licensed insurance companies offering major medical individual health plans in Maine are Anthem, Harvard Pilgrim/Point32, UnitedHealthcare, Maine Community Health Options and Taro Health (in certain counties).

CoverME.gov is Maine’s official state-run health insurance marketplace that works to ensure Mainers understand their health insurance options. For questions about whether you are eligible to enroll in a major medical plan outside of open enrollment, you can call CoverME.gov directly at 1-866-636-0355; TTY: 711.

For more information regarding red flags when purchasing health insurance, please see the Bureau of Insurance Guide to Purchasing Health Insurance Online, available with our consumer guides at: https://www.maine.gov/pfr/insurance/consumers/consumer-guides#health

Maine laws on Balance Billing and the Federal No Surprises Act

You may be wondering, what is balance billing or surprise billing?

It is when you see a doctor or other health care provider, and you are billed for other costs or have to pay the entire bill if you see a provider or visit a health care facility that isn’t in your health plan’s network.

“Out-of-network” describes providers and facilities that haven’t signed a contract with your health plan. Out-of-network providers may be permitted to bill you for the difference between what your plan agreed to pay and the full amount charged for a service. This is called “balance billing.” This amount is likely more than in-network costs for the same service and might not count toward your annual out-of-pocket limit.

“Surprise billing” is an unexpected balance bill. This can happen when you can’t control who is involved in your care—like when you have an emergency or when you schedule a visit at an in-network facility but are unexpectedly treated by an out-of-network provider.

You are protected from balance billing for:

Emergency services

If you have an emergency medical condition and get emergency services from an out-of-network provider or facility, the most the provider or facility may bill you is your plan’s in-network cost-sharing amount (such as copayments and coinsurance). You can’t be balance billed for these emergency services. This includes services you may get after you’re in stable condition, unless you give written consent and give up your protections not to be balanced billed for these post-stabilization services.

Certain services at an in-network hospital or ambulatory surgical center

When you get services from an in-network hospital or ambulatory surgical center, certain providers there may be out-of-network. In these cases, the most those providers may bill you is your plan’s in-network cost-sharing amount. This applies to emergency medicine, anesthesia, pathology, radiology, laboratory, neonatology, assistant surgeon, hospitalist, or intensivist services. These providers can’t balance bill you and may not ask you to give up your protections not to be balance billed.

If you get other services at these in-network facilities, out-of-network providers can’t balance bill you, unless you give written consent and give up your protections.

You’re never required to give up your protection from balance billing. You also aren’t required to get care out-of-network. You can choose a provider or facility in your plan’s network.

The State of Maine provides protection to patients from abusive billing practices and unnecessary patient fees. It requires providers to alert patients when they’ve been referred out-of-network.

When balance billing isn’t allowed, you also have the following protections:

You are only responsible for paying your share of the cost (like the copayments, coinsurance, and deductibles that you would pay if the provider or facility was in-network). Your health plan will pay out-of-network providers and facilities directly.

Your health plan generally must:

- Cover emergency services without requiring you to get approval for services in advance (prior authorization).

- Cover emergency services by out-of-network providers.

- Base what you owe the provider or facility (cost-sharing) on what it would pay an in‑network provider or facility and show that amount in your explanation of benefits.

- Count any amount you pay for emergency services or out-of-network services toward your deductible and out-of-pocket limit.

If you believe you’ve been wrongly billed, you may contact your insurance carrier by calling the number on your insurance card. You may also click here to file a complaint with the Maine Bureau of Insurance (External Site).

Click here to visit the CMS.gov Ending Surprise Medical Bills site (External Site).

Source: Your Rights and Protections Against Surprise Medical Bills – University of Maine System

How to read an explanation of benefits (EOB)

We all know that reading an explanation of benefits from your health insurance provider can be very confusing. CMS has a webpage that explains what an EOB looks like and how to read one. You can find the page here… How to read an explanation of benefits | CMS

Compare costs before you receive care

Did you know that you can compare costs before you receive care? The Maine Health Data Organization has a great site where you can compare costs at 344 healthcare settings in Maine, including hospitals, surgical centers, diagnostic imaging centers, health centers, laboratories, and clinics. Before your next procedure, make sure to check costs. Scheduling with another health provider in your network may save you a lot of money.